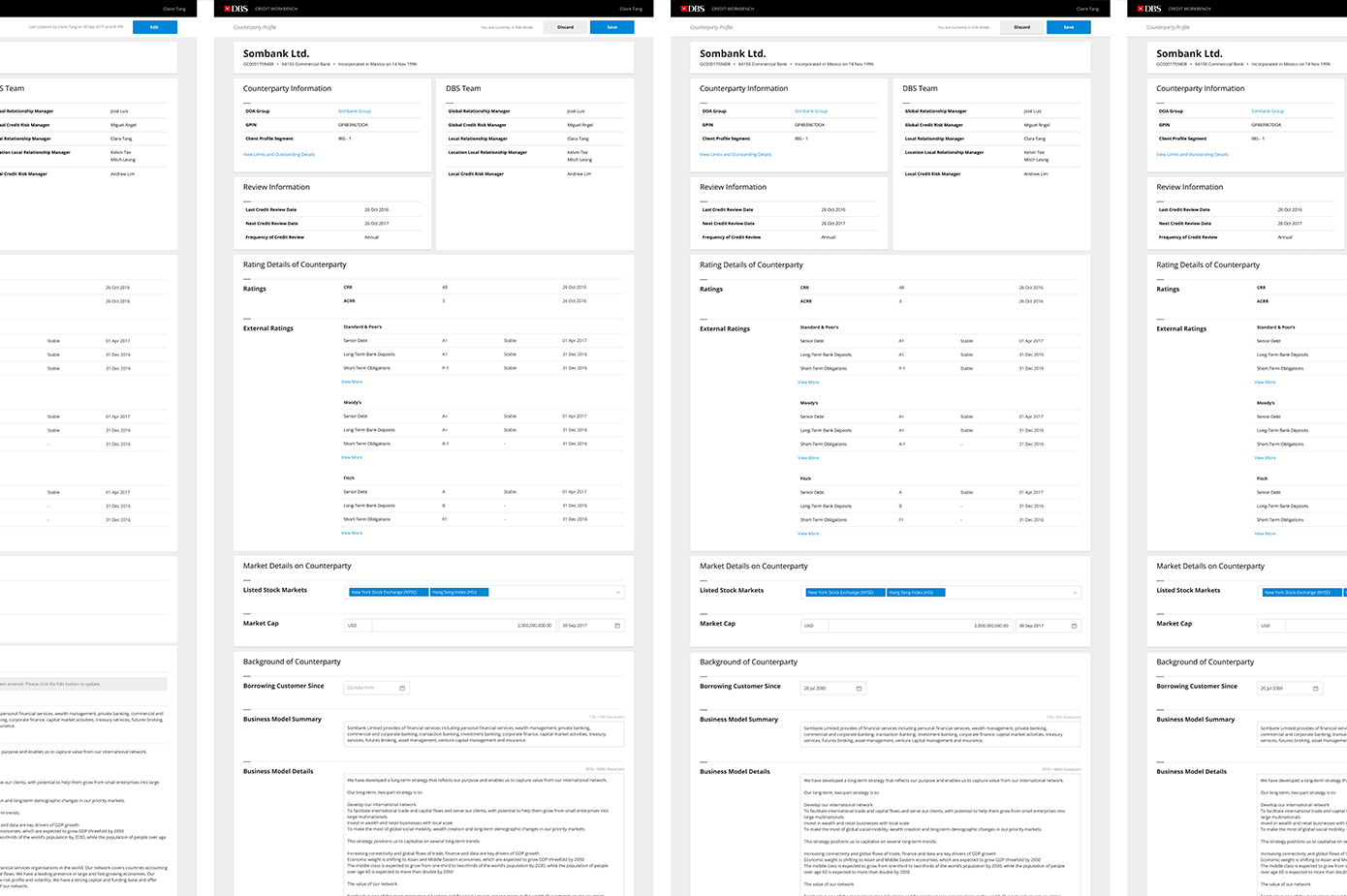

Borrower Profile Builder for Credit Origination Process

Client

DBS Bank Singapore (2017)

Product team

1x Lead Product Designer and Consultant (me)

1x Lead Product Manager and Consultant

1x Lead Software Engineer and Consultant

1x Client Product Designer

1x Client Product Manager

1x Client Software Engineer

Opportunity

Credit Origination is the process by which a lender or other credit granting institution approves for a new credit product or exposures (such as a new loan, mortgage, credit card etc) and performs initial processing. Origination starts with an application from a new or existing client and (for approved transactions) ends with the remittance of any upfront monies and the integration of the new exposure into the existing Credit Portfolio.

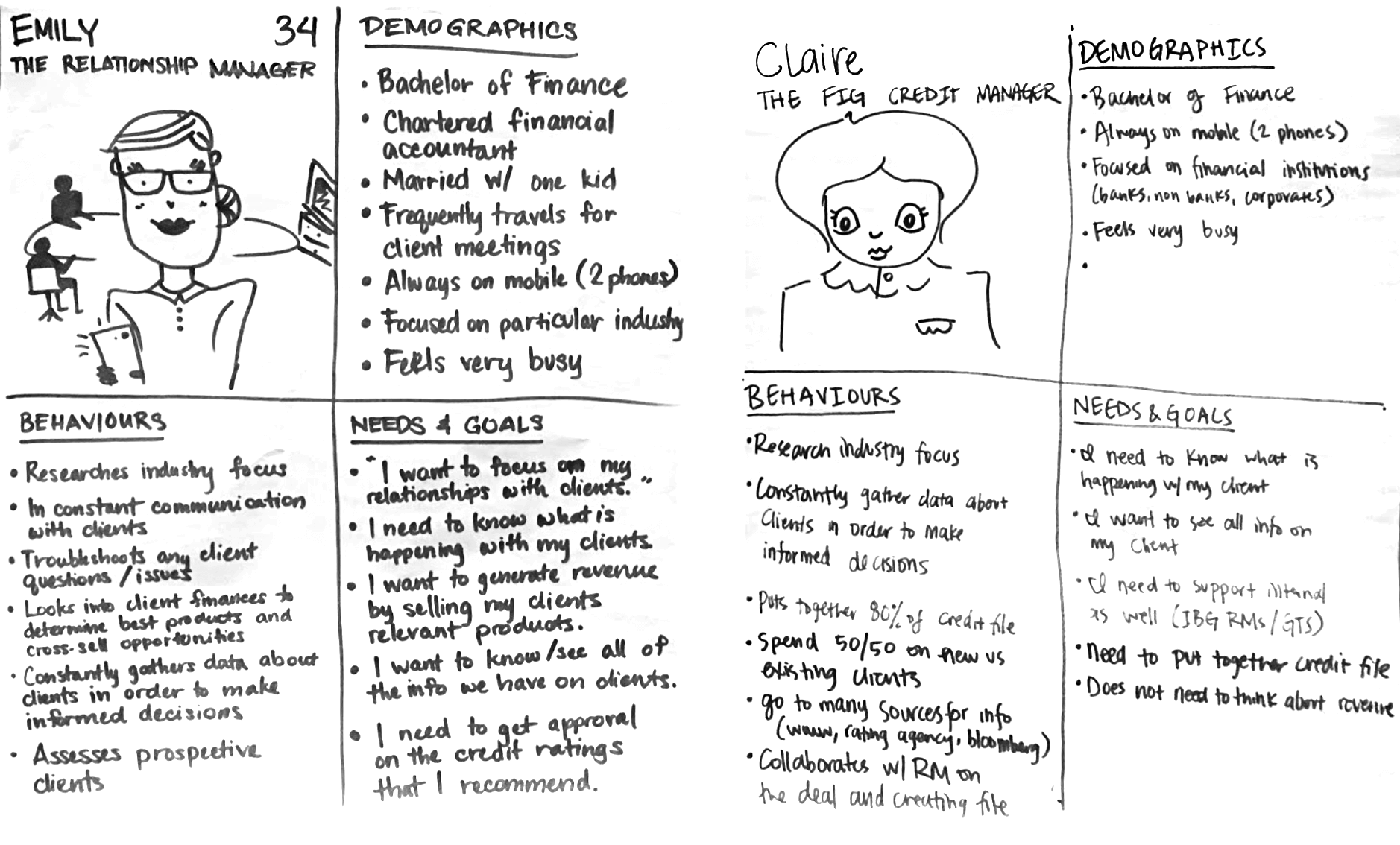

The process of building out a borrower profile at DBS Bank was arduous and cumbersome. Relationship Managers, who are responsible for building out these profiles, still worked heavily with paper. They built this paper borrower profile with information gathered from other paper borrower profiles and multiple internal systems, all of which which was often outdated, and also conflicting because they didn't talk to each other. They would then find the most recent information, update it in their paper profile, but not anywhere else in the bank's internal systems. As a result, the "profile source of truth" for a borrower resided with the person who built it, often on their machine's hard drive. This left stakeholders at the bank unable to access it when needed. It was often also difficult to track who the Relationship Manager was for a given borrower, which meant there was often a lot of asking around and digging around for the paper borrower profile.

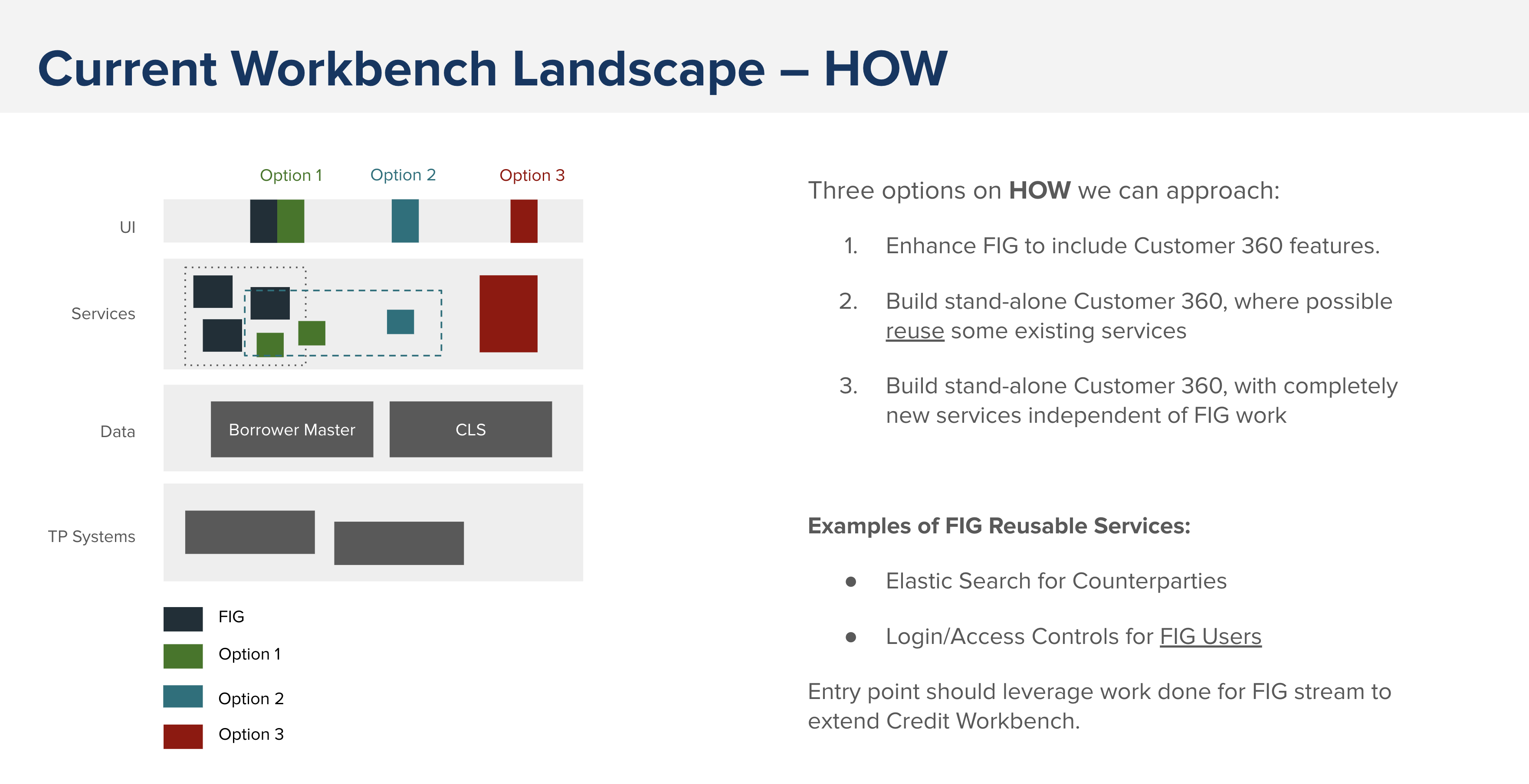

DBS Bank engaged us to help them build a product that would make this process easier.

Outcome

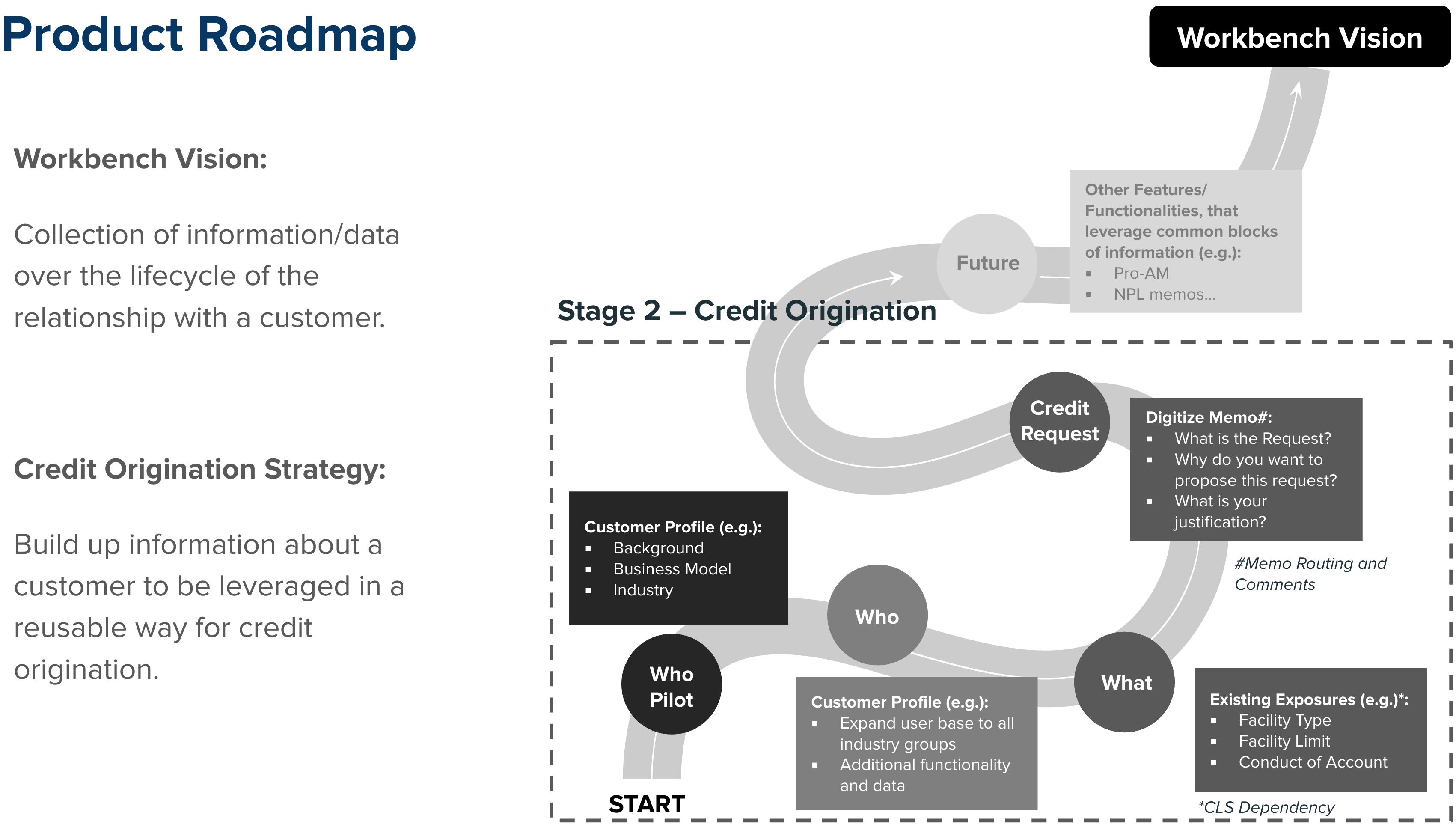

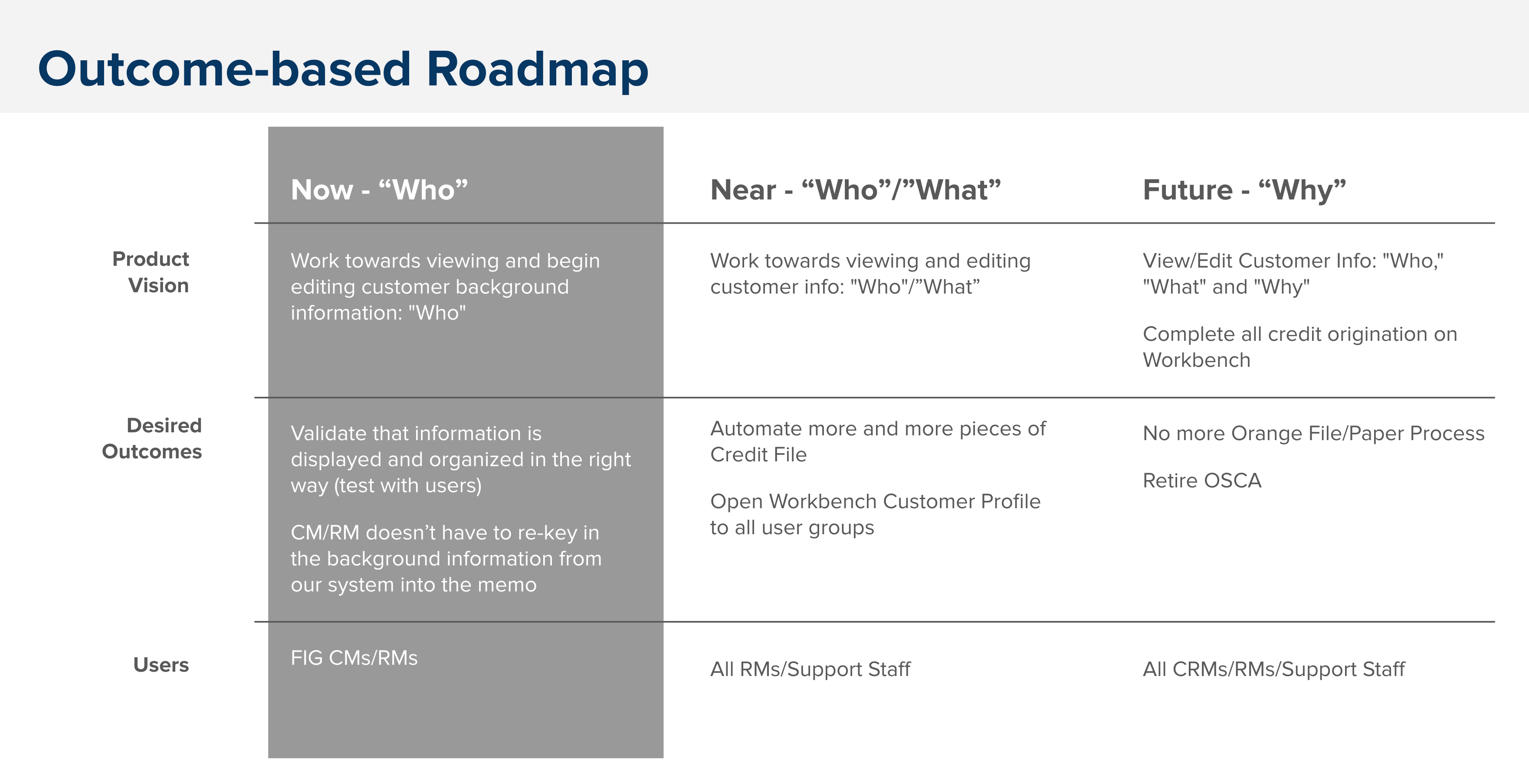

Our solution was a web application that made it easier for Relationship Managers to collect information and data over the lifecycle of the relationship with their customers, with the goal to automate, eliminate repetition, and re-use data for future purposes.

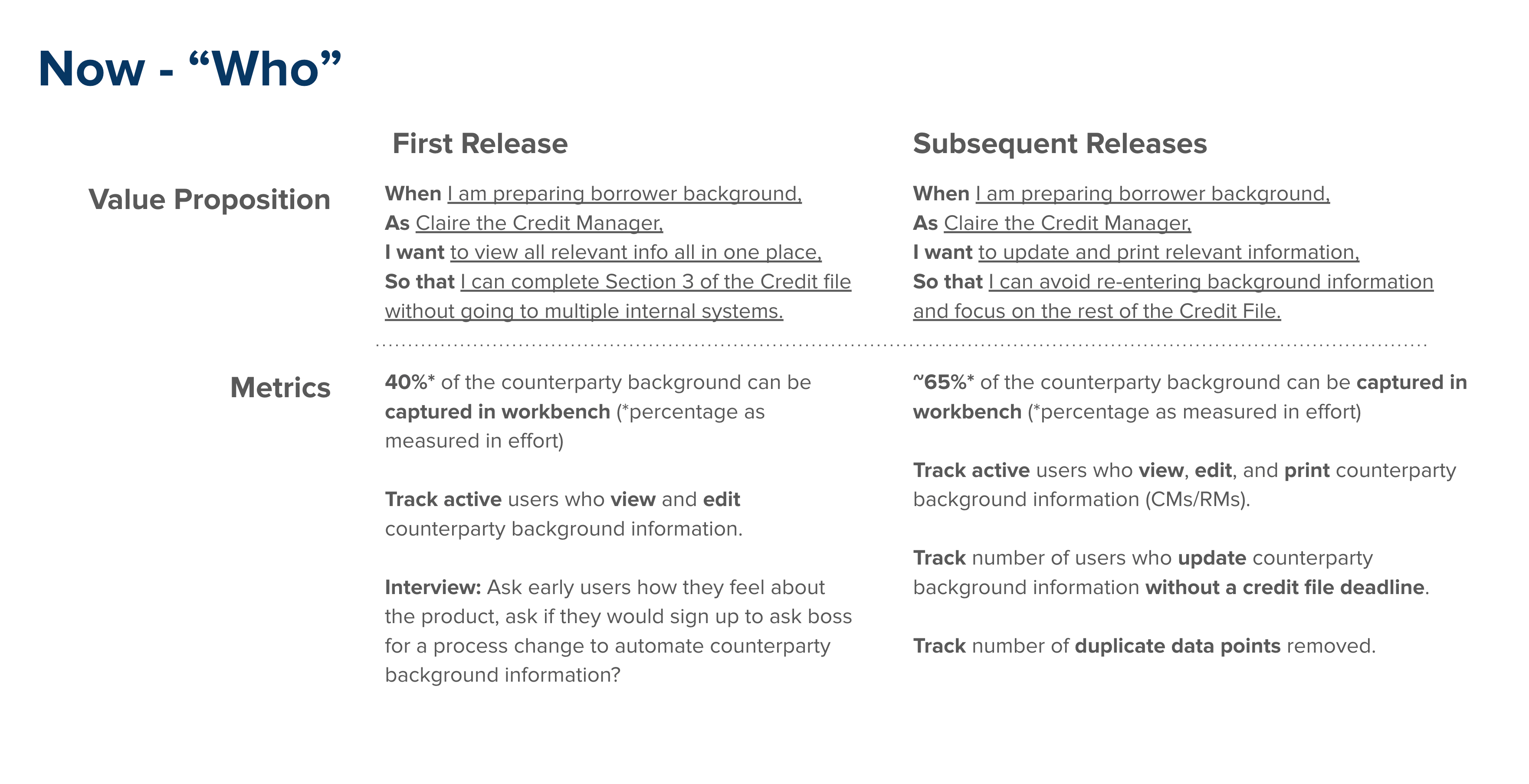

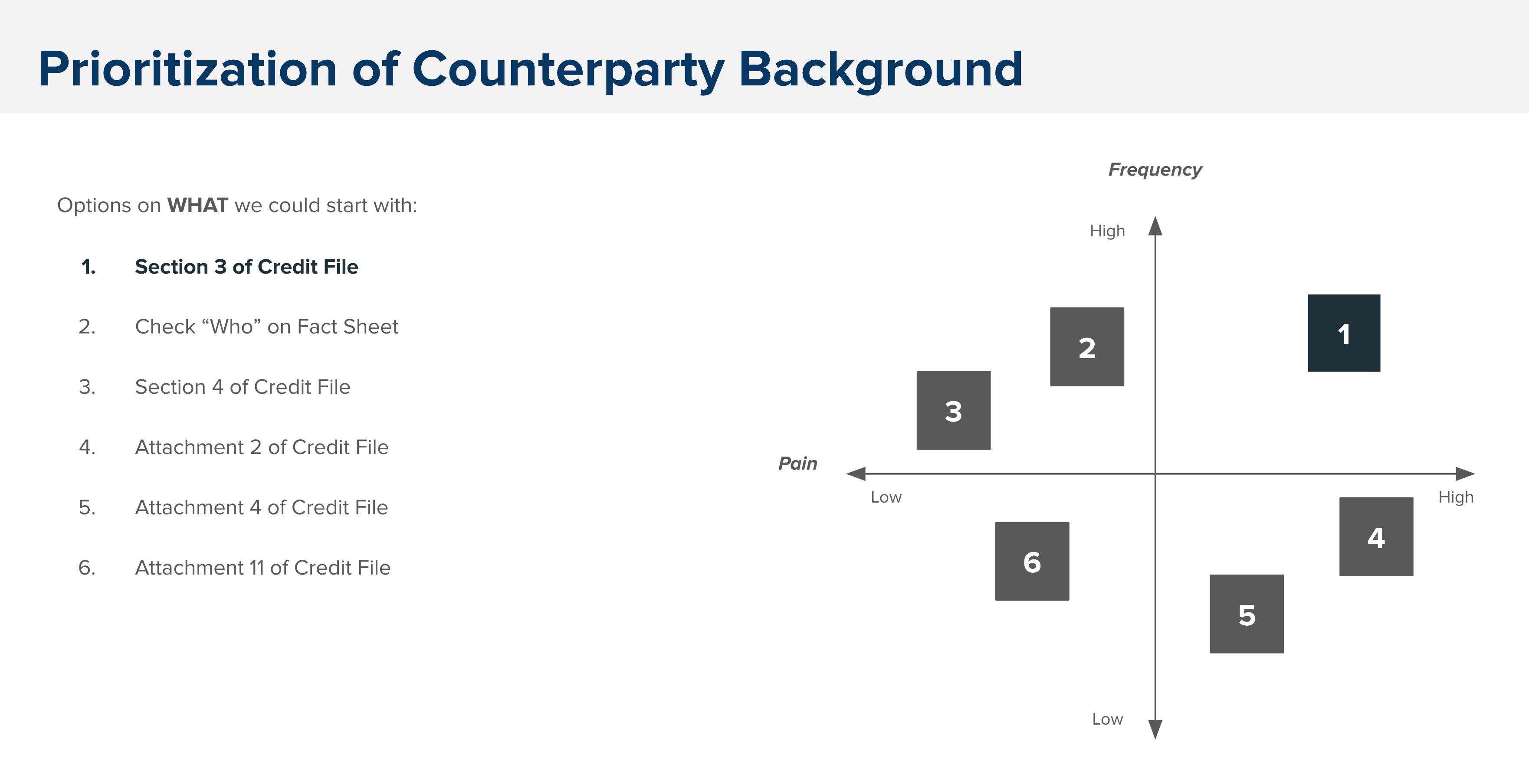

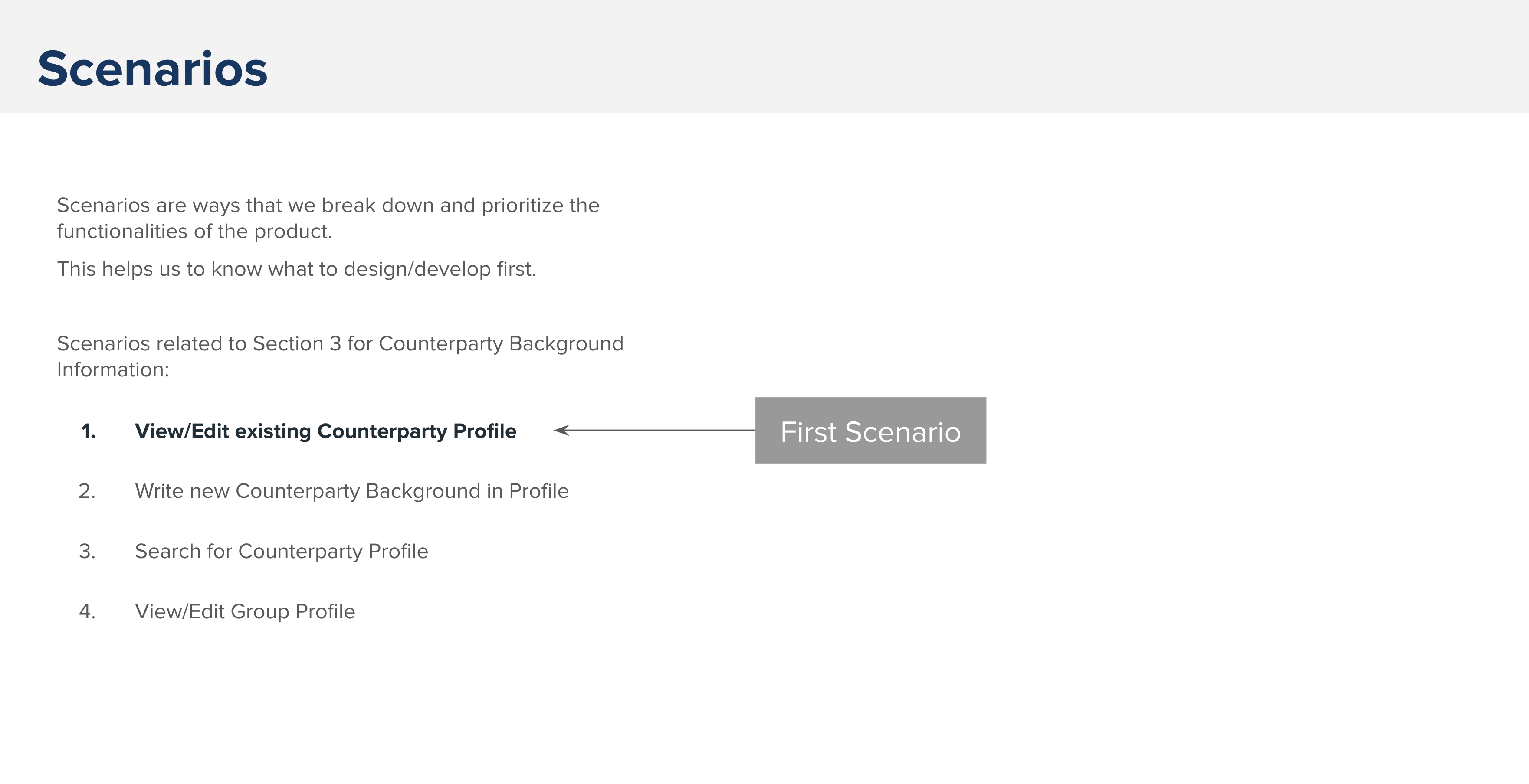

First release features included:

Login

Search

View Basic Information

View Section 3 Information

Edit Section 3 Qualitative Information

Save Section 3 Qualitative Information

Subsequent releases included:

- View, Edit, Print and Replace the following:

- Section 3

- Section 4

- Attachment 2

- Attachment 4

- Attachment 11

- Parts of Fact Sheet

- Enhanced Edit Feature

- Change Log

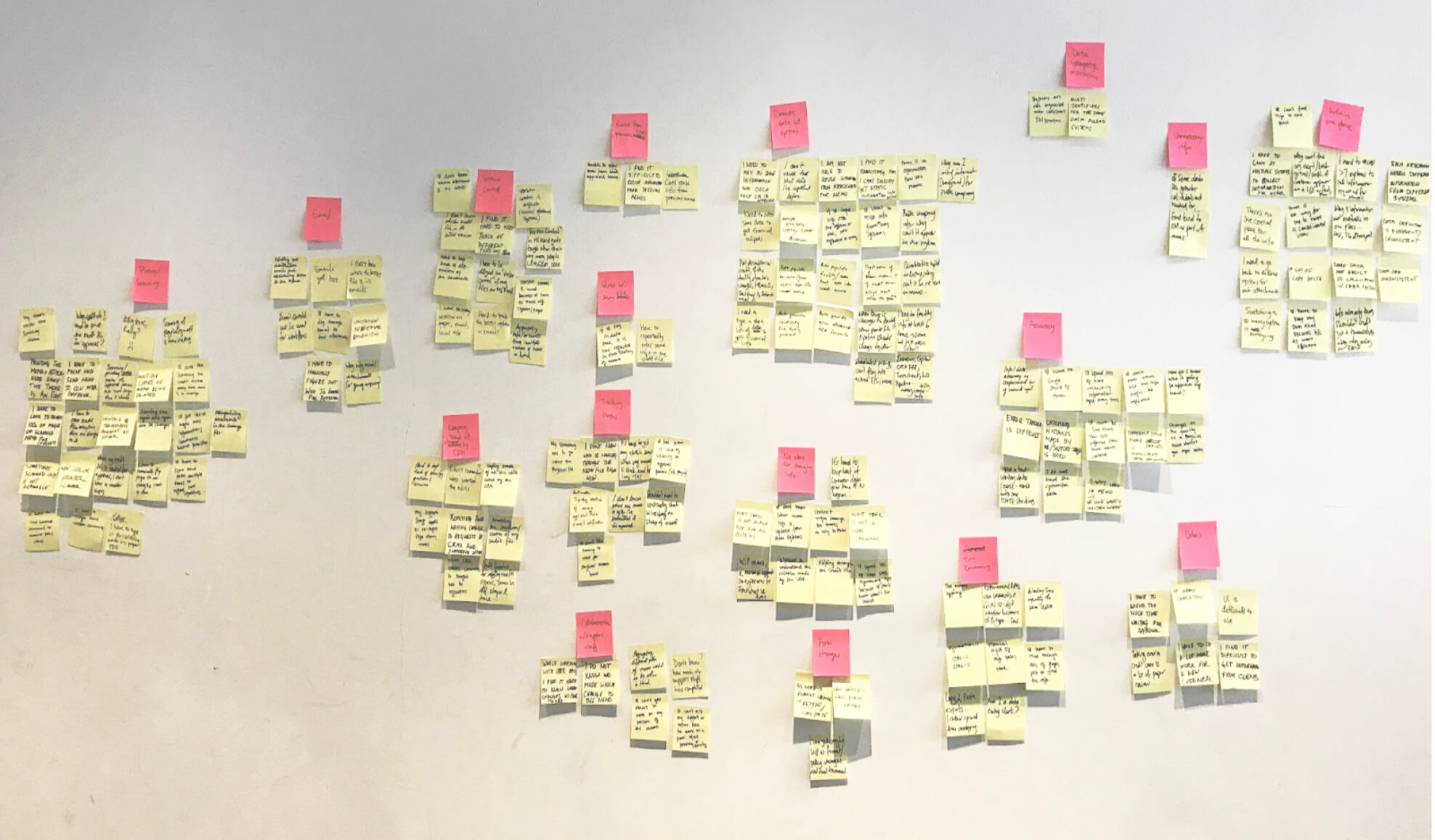

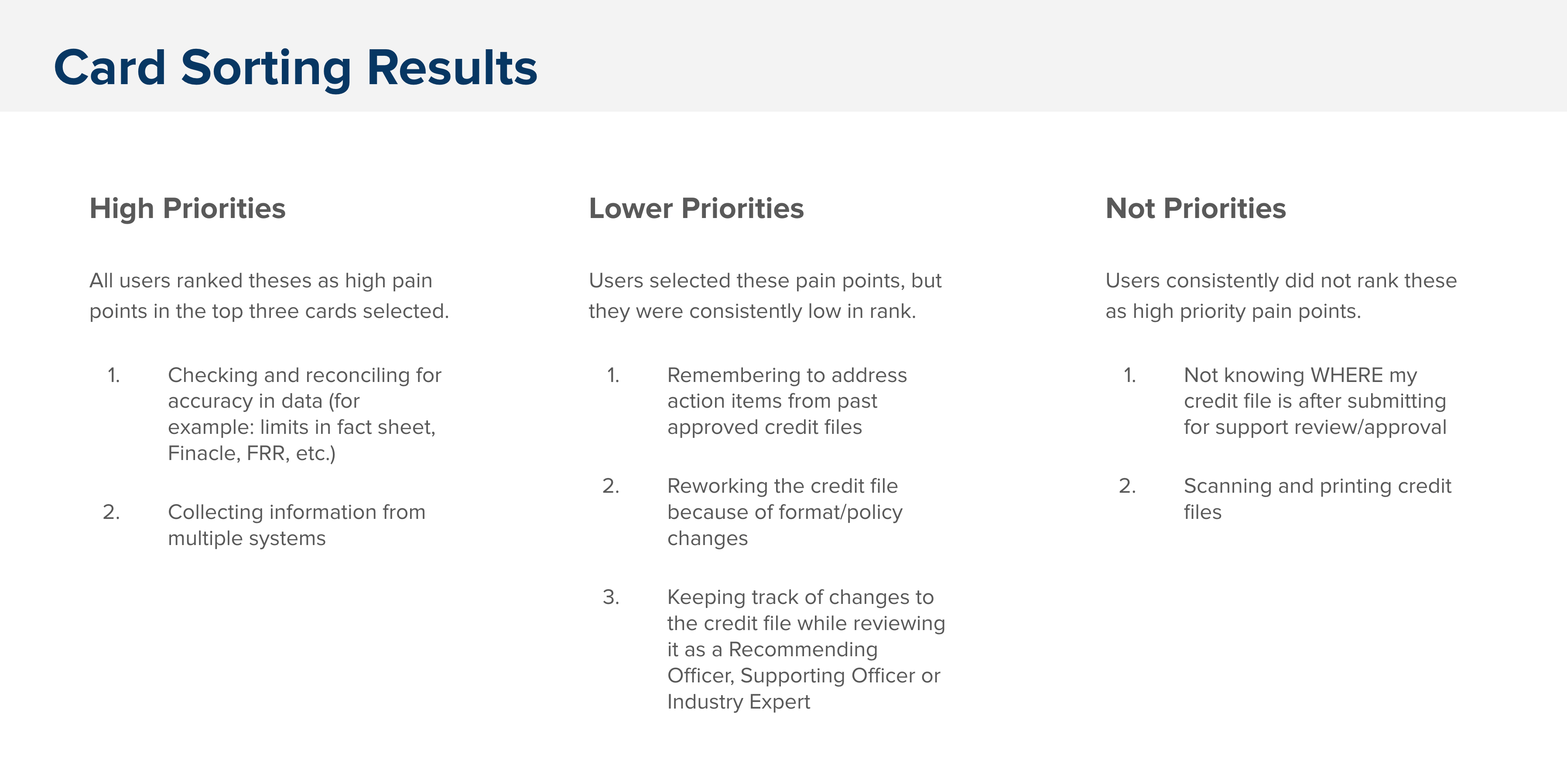

Problems we heard from users

Selected Works

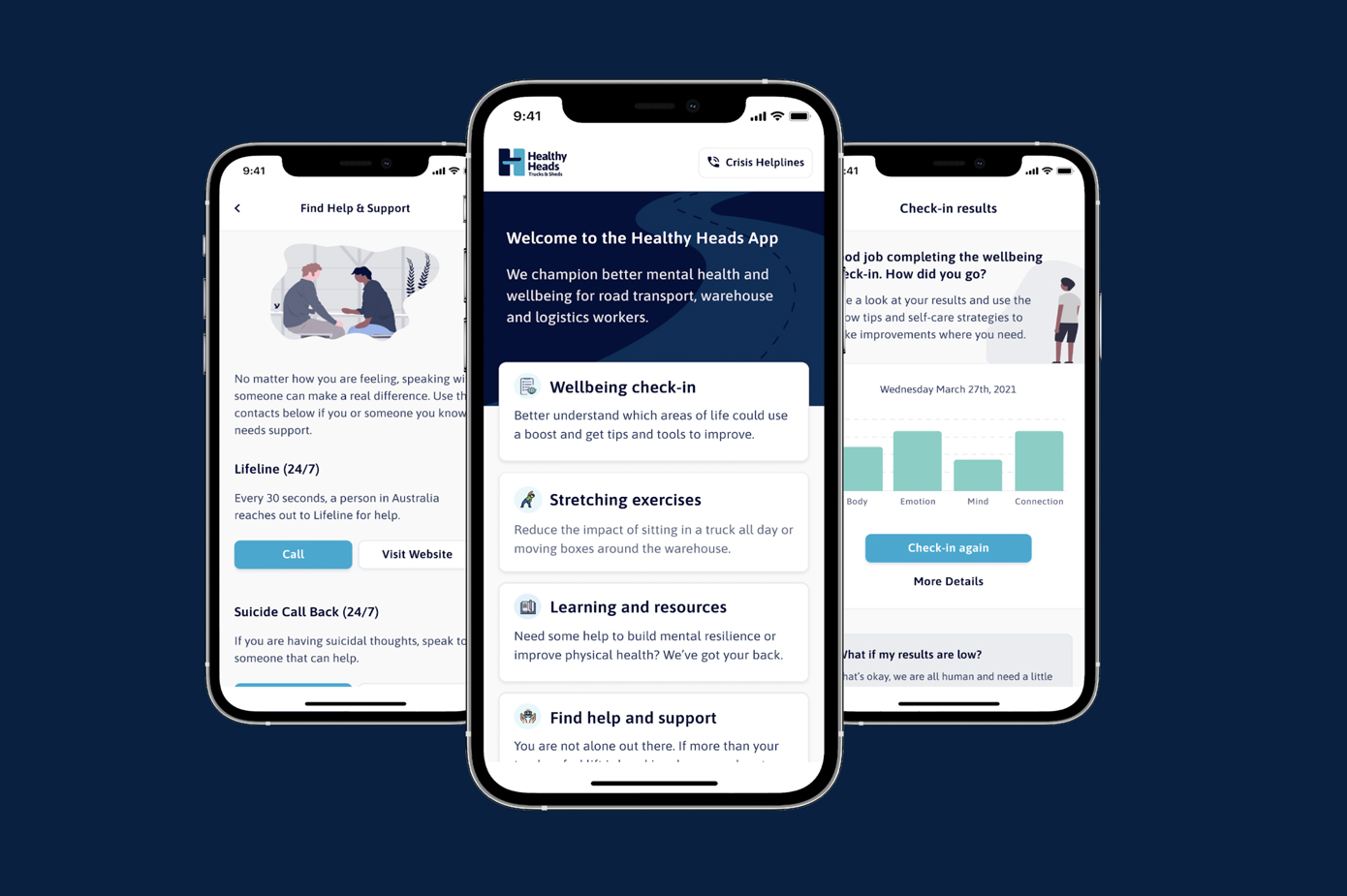

Healthy Heads in Trucks & Sheds Mobile AppMental Health

Medical Diagnostics Appointment DiaryHealthcare

Borrower Profile Builder for Credit Origination ProcessFinancial Services

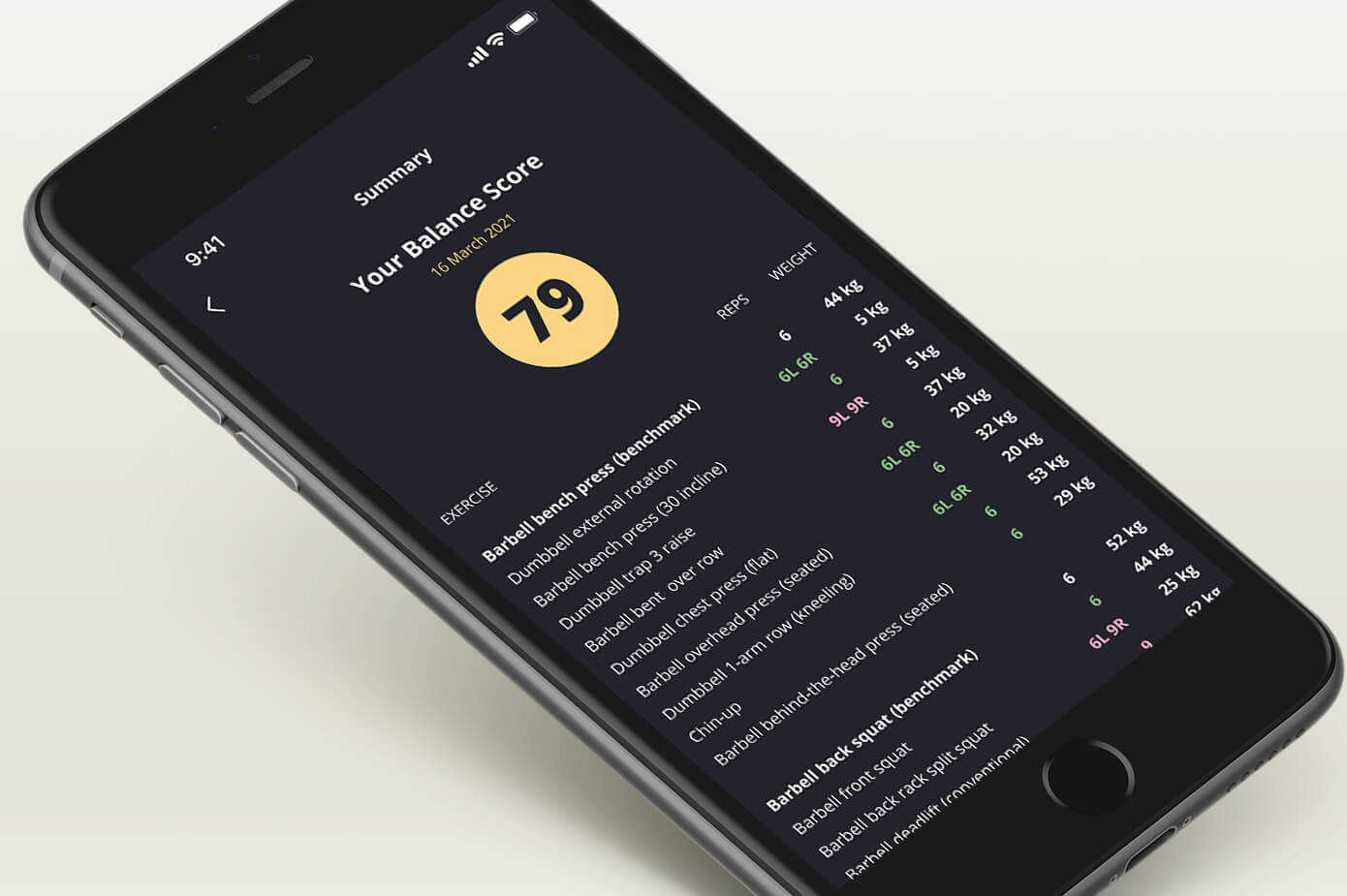

Structural Balance Testing AppHealth & Wellness

Index Engine: Manager and CalculatorFinancial Services

Fyt.club: Gamified Fitness and Wellness AppHealth & Wellness